In connection with this expertise, we are attentive to the regulations at European level (1).

The detailed analysis of the circumstances prevailing for the valuation of the debtor entity will become essential in the collective insolvency proceedings; we are able to contribute to it in many cases.

(1) “Directive (EU) 2019/1023 of the European Parliament and of the Council on preventive restructuring frameworks, on discharge of debt and disqualifications, and on measures to increase the efficiency of procedures concerning restructuring, insolvency and discharge of debt, and amending Directive (EU) 2017/1132 (Directive on restructuring and insolvency)”, June 20, 2019.

Our technical skills

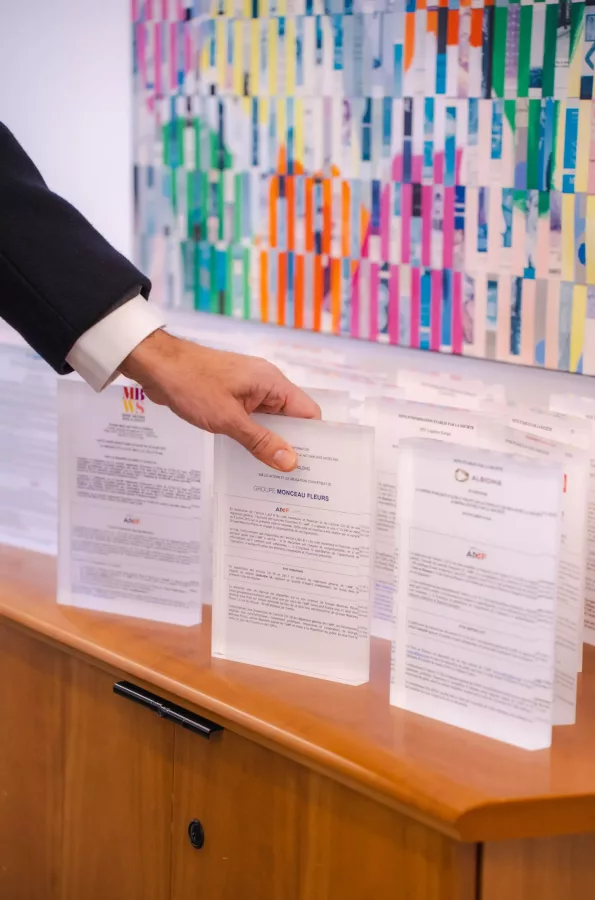

These assignments, partly conducted under the rules of the AMF General Regulations, may cover in particular the consistency between financial diagnosis, future cash-flows and financing sources.

Analyzing the different recapitalization scenarios and their impact on the stakeholders in the restructuring process;

Financial valuation of assets available for sale.

Valuation of equity, debt instruments including convertibles and options.